Keeping Perspective - Why Bonds?

- Justin Lueger

- Jul 21, 2025

- 2 min read

When we talk with friends about investing, the conversation is almost always about stocks. Rarely do we discuss bonds. Stocks are more exciting. Over time they have offered higher returns than bonds. For example, over the past 60 years, stocks have returned more than 10% annually while government bonds have earned slightly less than 6%.

The question you may ask yourself at times is why should anyone even own bonds? Yes, stocks will make you more money over time, but there is a place for bonds in your portfolio.

What bonds do is act as a buffer when stocks are falling in value. They can help make the ride smoother when going through a recession as they are much steadier and more predictable than stocks.

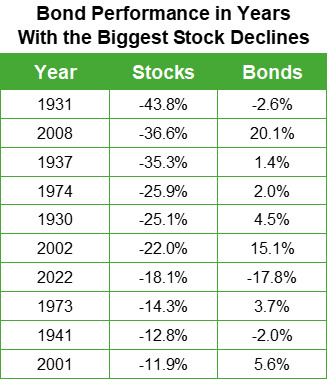

When stock prices are down, bond prices tend to go up – and vice versa. If you look at the 10 worst years in the stock market, bonds in those same years averaged a 3% increase in value; meanwhile stocks were down an average of -24.6%.

Since 1976 stocks have had an average intra-year drop of -14.1%. That means at some point in the calendar year, stocks were on average selling for about 14% less than they were at the start of the year. Bonds on the other hand have had an average intra-year drop of just -3.5%. The downside is much less with bonds. Also, since 1976, bonds have had only five down years while stocks have had 11 down years. This shows just how volatile stocks are compared to bonds.

Besides being less risky than stocks, bonds have historically outperformed cash and CDs. Bonds have done a much better job at keeping up with inflation over time compared to cash.

So how much of your portfolio should be invested in bonds? If you are over 20 years away from retirement, you could justify not having bonds at all…as long as you don’t mind the volatility that stocks bring. More risk-averse investors who are 20 years away from retirement may want to have a portion of their portfolio invested in bonds – but probably no more than 20%.

Once you are near retirement or in retirement, it becomes much more important to have a sizable portion of your portfolio protected from the ups and downs of the stock market. Any money that you will need within eight years or less should be invested in more conservative investments like bonds, and preferably short-term or intermediate-term bonds.

If you only own stocks in retirement and need to withdraw money while stocks are on a downhill slide, you would be locking in those short-term losses. Doing so could derail your retirement plans. The goal should be to avoid selling stocks when prices are down. Doing otherwise can be a real risk to ensuring your retirement funds outlive you.

If you’re unsure what your mix of bonds and stocks should be, make sure to reach out to your financial advisor. They can build a portfolio customized to your unique situation.

Comments